When To File ISF For Garment Rivets

When am I required to file an Importer Security Filing (ISF) for garment rivets? The ISF is a critical component in the global supply chain, specifically for companies importing goods into the United States. Understanding when and how to file ISF for garment rivets can be quite more complex than it may initially seem.

Understanding Importer Security Filing (ISF)

The Importer Security Filing, commonly referred to as ISF, is a requirement set forth by U.S. Customs and Border Protection (CBP). It mandates that certain information about imported goods be submitted before shipment leaves its point of origin. This process is designed to enhance security and help prevent illegal activities such as smuggling or terrorism.

Why Is the ISF Important?

The ISF is critical not just for compliance purposes but also for the efficiency of the supply chain. It allows CBP to assess potential risks associated with imported goods. A properly filed ISF can expedite customs clearance, while non-compliance may lead to delays and penalties.

What Are Garment Rivets?

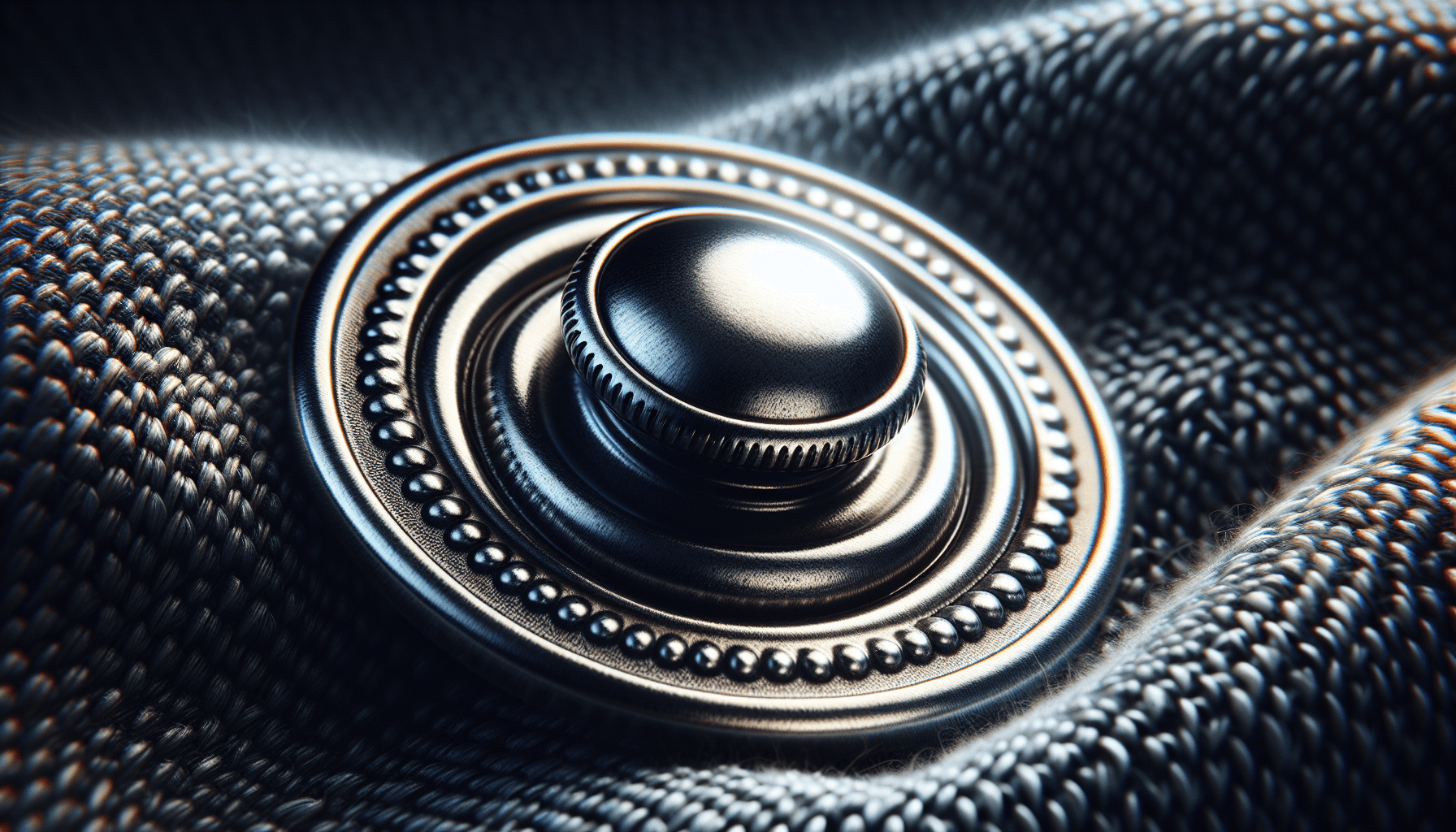

Garment rivets are metallic fasteners often used in clothing and textile manufacturing. They provide strength and durability to garments, particularly in areas subject to stress, such as pockets and seams. These small yet essential components of fashion not only enhance the longevity of a garment but also contribute to its aesthetic appeal.

Type of Garment Rivets

Various types of garment rivets exist, including:

- Flat Rivets: Often used for their minimalist aesthetic.

- Round Rivets: Commonly found in jeans and heavy-duty clothing.

- Cap Rivets: Feature a decorative cap that is visible, providing a stylish touch.

- Brittle Rivets: Used for lightweight applications, ensuring easy application.

The choice of rivet affects not only the garment’s design but also its functionality. It is essential to understand which rivets will be used before proceeding with the ISF filing.

Filing ISF for Garment Rivets

The requirement to file an ISF for garment rivets arises from their classification as components of clothing. When I import garments that utilize rivets, I must be aware of the specific requirements that pertain to these components.

When to File ISF for Garment Rivets

-

Imported Shipment: Whenever I import garment rivets as a standalone item or as part of a larger shipment of garments, I am required to file an ISF.

-

Manufacturer Information: It is crucial to provide information about the manufacturer of the garment rivets, including name and address.

-

Port of Arrival: My filing must also include the port of arrival for the garments, as this data is essential for customs processing.

-

Harmonized Tariff Schedule (HTS) Code: Each type of garment rivet should be assigned a specific HTS code. The correct classification is vital for determining duties and taxes.

-

Container Information: Details regarding the containers that will be transporting the rivets are also necessary for an accurate ISF submission.

Lead Time for Filing

The ISF must be filed at least 24 hours before the cargo is loaded onto the vessel. This time frame allows customs authorities to conduct risk assessments. I should always ensure that I have all necessary information at hand well before this deadline to avoid any issues.

Common Mistakes to Avoid

-

Incomplete Information: One of the most prevalent mistakes is failing to provide complete and accurate data. This can lead to lengthy delays or penalties.

-

Misclassification of Goods: Incorrectly classifying garment rivets under the wrong HTS code can result in over or under-payment of duties and customs fees.

-

Late Filing: Submitting the ISF past the 24-hour deadline can lead to non-compliance issues. It is vital to have a reliable system in place to manage ISF submissions.

Implications of Filing Errors

Filing errors can lead not just to monetary penalties but also affect supplier relations and shipment timelines. Understanding these implications is crucial in ensuring a smooth supply chain for my business.

Financial Penalties

Failing to file the ISF on time or submitting incorrect information can lead to a variety of financial penalties. These fines can quickly accumulate, impacting my bottom line significantly.

Increased Scrutiny

Repeated errors in ISF filings may lead CBP to flag my shipments for further scrutiny, potentially resulting in delays that could affect customer satisfaction. This not only creates logistical problems but can also tarnish the company’s reputation.

Best Practices for Filing ISF for Garment Rivets

-

Stay Informed: Keeping abreast of any changes in customs regulations is essential for maintaining compliance.

-

Utilize Technology: Leveraging automated systems can help streamline the ISF submission process, reducing the risk of human error.

-

Work with Professionals: Consulting with customs brokers or trade compliance specialists can provide valuable insight and assistance in navigating ISF requirements.

Organizing Documentation

Ensuring that all documentation related to the garment rivets is organized and readily accessible can significantly reduce the chances of errors when filing.

Establishing Compliance Checkpoints

Before shipping any garments with rivets, I can establish internal compliance checkpoints. This could involve a review process to ensure that all information being submitted is accurate and complete.

Collaboration with Suppliers

Effective communication with suppliers is crucial for ensuring that necessary information is provided for ISF filings. When I engage with my suppliers, I emphasize the importance of timely and accurate information sharing.

Information Requirements

I will need the following information from my suppliers regarding garment rivets:

- Manufacturer details

- Material composition

- Specific HTS codes for the rivets

- Packaging information

Encouraging suppliers to provide clear and structured data can help facilitate the ISF submission process.

Conclusion

Understanding when and how to file an ISF for garment rivets is crucial in today’s global supply landscape. I must adhere to the U.S. Customs and Border Protection regulations, as non-compliance can have serious implications. By staying informed, avoiding common pitfalls, and collaborating effectively with suppliers, I can streamline this process to ensure the timely import of my garments.

Navigating the world of imports can indeed be complex, but with the right knowledge and practices in place, I can facilitate a smoother transition of goods into the market. Failing to adhere to the ISF regulations might not only incur penalties but also disrupt my overall business operations. Therefore, I understand that my diligence in filing ISF for garment rivets is indispensable to my continued success in the garment industry.